Primary investment countries:

Slovenia, Croatia, Serbia, Bosnia and Herzegovina, Montenegro, Kosovo, North Macedonia

Secondary investment countries:

Hungary, Romania, Bulgaria, Albania

Primary investment countries:

Slovenia, Croatia, Serbia, Bosnia and Herzegovina, Montenegro, Kosovo, North Macedonia

Secondary investment countries:

Hungary, Romania, Bulgaria, Albania

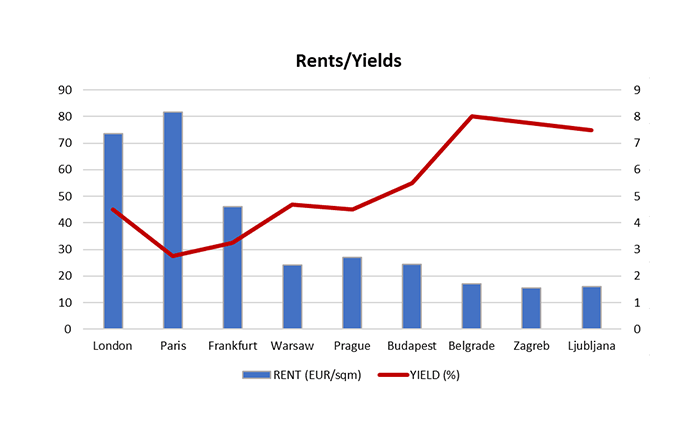

| REGION | CITY | RENT (EUR/sqm) | YIELD (%) |

| Western EU | London | 73.7 | 4.5 |

| Paris | 81.7 | 2.75 | |

| Frankfurt | 46 | 3.25 | |

| Central EU | Warsaw | 24 | 4.7 |

| Prague | 27 | 4.5 | |

| Budapest | 24.5 | 5.5 | |

| South-Eastern EU | Belgrade | 17 | 8 |

| Zagreb | 15.5 | 7.75 | |

| Ljubljana | 16 | 7.5 | |

| Source: Colliers, CBRE | |||

Focus on renewable energy investments

Regional private equity